Epstein accusers sue JP Morgan, Deutsche Bank; claim banks benefited from sex trafficking operation

Two anonymous women who accuse the late Jeffrey Epstein of sexual abuse have filed separate civil lawsuits against JP Morgan Chase & Co. and Deutsche Bank AG, claiming the big banks enabled and benefitted financially from Epstein's alleged sex trafficking operation.

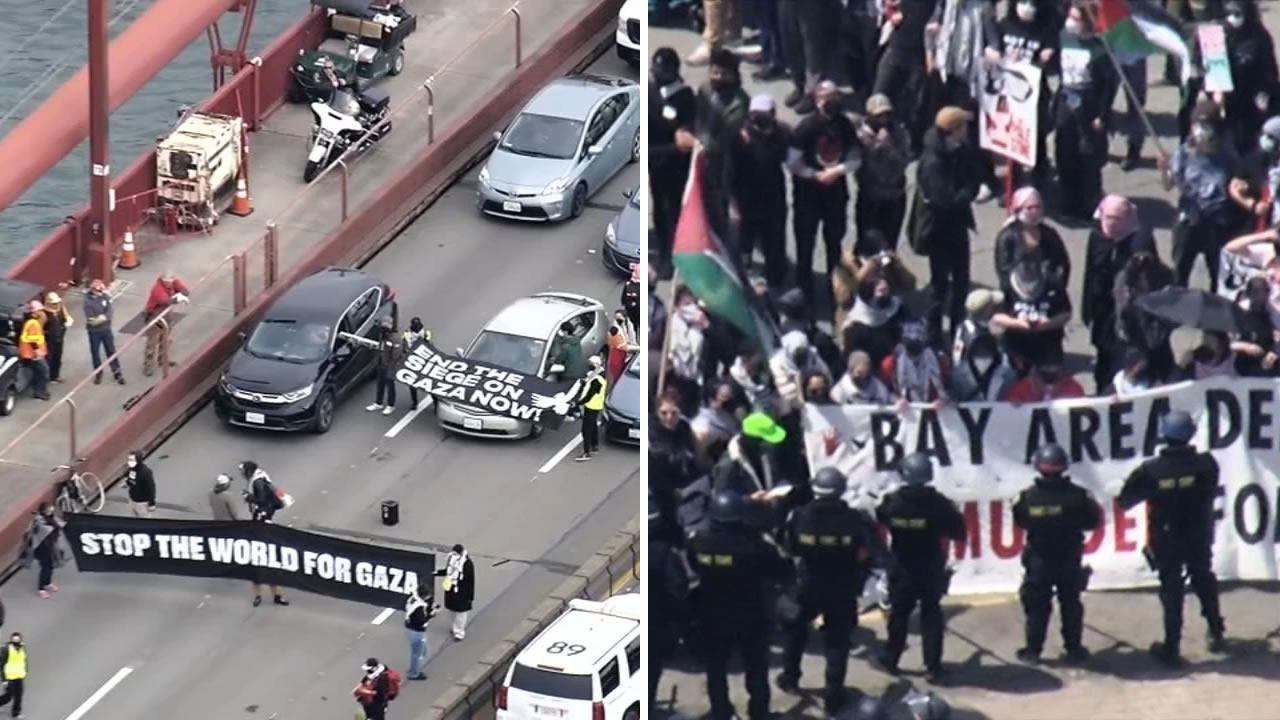

The video above is ABC7's 24/7 livestream.

The class action suits were filed in part under a new law in New York, which allows adult sexual abuse survivors to sue their alleged abusers, even if the statute of limitations has expired.

When he died, Epstein was awaiting trial on federal charges accusing him of operating a sex trafficking ring from 2002 to 2005 at his Manhattan mansion and his Palm Beach estate, and allegedly paying girls as young as 14 for sex.

The new lawsuit filed against JPMorgan accuses the financial institution of having "provided special treatment to the sex-trafficking venture, thereby ensuring its continued operation and sexual abuse and sex-trafficking of young women and girls."

"Without the financial institution's participation, Epstein's sex trafficking scheme could not have existed," the lawsuit states.

A separate lawsuit filed Thursday by a second anonymous woman representing a class of plaintiffs says when JP Morgan started "separating itself from Epstein" in 2013, Deutsche Bank "became the bank that Epstein needed to fund his sexual abuse and sex-trafficking operation."

RELATED: ABC News to premiere 2-hour special, 8-episode podcast on Jeffrey Epstein

"Knowing that they would earn millions of dollars from facilitating Epstein's sex trafficking, and from its relationship with Epstein, Deutsche Bank chose profit over following the law. Specifically, Deutsche Bank chose facilitating a sex trafficking operation in order to churn profits," the suit claims.

The suit alleges Deutsche Bank ignored red flags including payments to numerous young women and large withdrawals of cash.

In 2020, New York regulators fined Deutsche Bank $150 million and slammed the lender for "mistakes and sloppiness" in its relationship with Epstein.

According to the regulator, the bank was repeatedly made aware of past accusations against Epstein and his alleged accomplices as soon as he became a client.

In a statement at the time, Deutsche Bank said it acknowledged its "error of onboarding Epstein in 2013 and the weaknesses in our processes, and have learnt from our mistakes and shortcomings."

The suit says, "Without Deutsche Bank's assistance, Epstein could not have abused or trafficked the dozens of young women he did between 2013 and 2018."

Brian Blackstone, Head of Communications for the American Region at Deutsche Bank AG tells CNN "We believe this claim lacks merit and will present our arguments in court."

Plaintiffs are seeking unspecified damages to be determined by a jury trial.

(The-CNN-Wire & 2022 Cable News Network, Inc., a Time Warner Company. All rights reserved.)